目次

- 1. Difference between “National Pension” and “Employees’ Pension”

- 2. How to calculate the amount of the Lump-sum Withdrawal Payment for the National Pension

- 3. How to calculate the amount of the Lump-sum Withdrawal Payment for the Employees’ Pension

- 4. Introducing LIGHTBOAT’s Lump-sum Withdrawal Payment Support Service

- 5. Summary

“If I’ve been paying the pension premium for three years, how much will I get when I return home?”

”How can I calculate the amount of the Lump-sum Withdrawal Payment I will receive?”

You might have checked out how to calculate the payment amount before you return home, but you may be feeling overwhelmed because it seems complicated.

Foreign residents in Japan must contribute to either the “National Pension” or the “Employees’ Pension.” In order to receive the Lump-sum Withdrawal Payment, you need to know the difference between the two pensions, and correctly calculate the amount.

This article briefly explains the difference between the “National Pension” and the “Employees’ Pension” and how to calculate the amount of the Lump-sum Withdrawal Payment. We also introduce LIGHTBOAT’s automatic calculator for the payment amount, and our support service for your claim. Please take advantage of our service.

1. Difference between “National Pension” and “Employees’ Pension”

First, we will give a brief overview and the difference between the “National Pension” and the “Employees’ Pension.”

“National Pension (Kokumin nenkin)” is a public pension system in which all residents of Japan between the ages of 20 and 59 must be enrolled. Eligible individuals include students, self-employed workers and their spouses, and unemployed persons.

“Employees’ Pension (Kosei nenkin)” is a pension insurance system for people working for Japanese companies. Technical intern trainees working in Japan are also applied to the Employees’ Pension.

Reference) Difference between National Pension and Employees’ Pension

| National Pension | Employees’ Pension | |

| Individuals who must be covered | All residents in Japan aged between 20 and 59 (students, self-employed workers and their spouses, unemployed persons, part-time workers, housewives etc.) | Company employees and government employees |

| Premiums | Flat rate (¥16,590 in the FY2022) | Varies depending on income |

| Actual cost | Pay the full amount | Split between employer and employee |

| Minimum of the insured period | 10 years | 1 month |

If you have already left Japan, do not have a Japanese address, and had been enrolled in the National Pension System or the Employees’ Pension Insurance System for at least six months, you are eligible to receive the Lump-sum Withdrawal Payment.

The calculation of the Lump-sum Withdrawal Payment differs between the National Pension and the Employees’ Pension.

2. How to calculate the amount of the Lump-sum Withdrawal Payment for the National Pension

Here is how you calculate the payment amount for the National Pension.

First, you need to find out your National Pension contribution-paid period and the final month when the insurance premium was paid. Then, you will reflect them in the following table of the payment amount.

Table of the payment amount for the National Pension

| Contribution-paid period | April 2022~ March 2023 | April 2021~ March 2022 |

| 6 months to less than 12 months | ¥49,770 | ¥49,830 |

| 12 months to less than 18 months | ¥99,540 | ¥99,660 |

| 18 months to less than 24 months | ¥149,310 | ¥149,490 |

| 24 months to less than 30 months | ¥199,080 | ¥199,320 |

| 30 months to less than 36 months | ¥248,850 | ¥249,150 |

| 36 months to less than 42 months | ¥298,620 | ¥298,980 |

| 42 months to less than 48 months | ¥348,390 | ¥348,810 |

| 48 months to less than 54 months | ¥398,160 | ¥398,640 |

| 54 months to less than 60 months | ¥447,930 | ¥448,470 |

| 60 months and more | ¥497,700 | ¥498,300 |

The revision in Pension laws for the Lump-sum Withdrawal Payment has been effective since April 2021, and the upper limit has been extended to 60 months (five years) from 36 months (three years). If your final premium payment is before April 2021, please check the Japan Pension Service website for the amount of the Lump-sum Withdrawal Payment.

Japan Pension Service website: https://www.nenkin.go.jp/service/jukyu/sonota-kyufu/dattai-ichiji/20210401_01.html

3. How to calculate the amount of the Lump-sum Withdrawal Payment for the Employees’ Pension

The following is the calculation for the Lump-sum Withdrawal Payment for the Employees’ Pension.

First, you need to find out the average standard renumeration during the enrollment period, and the insured period in the Employees’ Pension. Then, you can apply them to the following formula to calculate the payment amount.

Calculation formula

| The amount of the Lump-sum Withdrawal Payment = Payment rate × Average standard renumeration |

The average standard remuneration is the average monthly salary. Your average monthly salary is calculated as follows.

Total of your salary of the insured period (base salary, bonus, overtime pay etc.) / Number of months you have worked= Average standard remuneration

Payment rate is as shown below.

| The insured period in the Employees’ Pension | The number used for the payment rate calculation | Payment rate |

| 6 months to less than 12 months | 6 | 0.5 |

| 12 months to less than 18 months | 12 | 1.1 |

| 18 months to less than 24 months | 18 | 1.6 |

| 24 months to less than 30 months | 24 | 2.2 |

| 30 months to less than 36 months | 30 | 2.7 |

| 36 months to less than 42 months | 36 | 3.3 |

| 42 months to less than 48 months | 42 | 3.8 |

| 48 months to less than 54 months | 48 | 4.4 |

| 54 months to less than 60 months | 54 | 4.9 |

| 60 months and more | 60 | 5.5 |

Example:

・Average standard remuneration : ¥200,000

・Insured period : September 2019 ~ September 2022 (36 months)

・Payment rate : 3.3

200,000 × 3.3 = ¥660,000

You need to apply the number above to the formula.

200,000 × 3.3 = ¥660,000

In this case, the payment amount is ¥660,000.

As with the National Pension, the maximum number of months of the Lump-sum Withdrawal Payment for the Employees’ Pension has been increased from three to five years since April 2021. Please note that the upper limit will be three years if your final payment was made before April 2021, although the payment rate will remain the same.

4. Introducing LIGHTBOAT’s Lump-sum Withdrawal Payment Support Service

The Lump-sum Withdrawal Payment procedure is time-consuming and requires a variety of documents. You may be concerned about how much refund you can receive, and whether you will be able to follow the correct procedures to obtain the payment.

LIGHTBOAT offers NENKIN Support, which is our service to help you smoothly process your claim for the Lump-Sum Withdrawal Payment. NENKIN Support conducts your claim and provides an automatic calculator.

・NENKIN Support

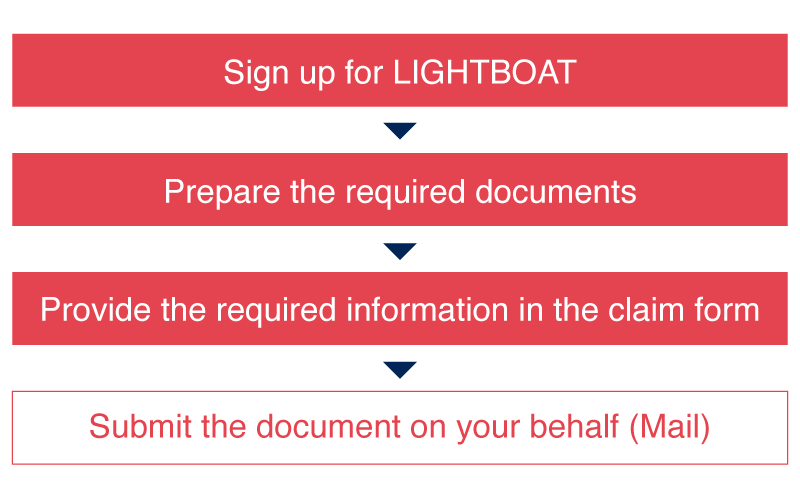

NENKIN Support conducts the total application process on your behalf, from the Lump-sum Withdrawal Payment to the income tax refund, simply by providing required information on our online form.

Once you enter your name, date of birth, address, bank account, pension number, and other necessary information into the form, the system will automatically generate the document for you. You can also use electronic seal, so you don’t need to handwrite anything at all! (For more details, please refer to the instructions below.)

・Automatic calculator

The automatic calculator allows you to calculate the payment amount by simply entering two items.

First, please find out the following information.

(1) Average standard remuneration (excluding tax)

(2) Insured period for the Employees’ Pension

When you enter the above information into the automatic calculator, your payment amount will be automatically calculated.

この計算機で10508名の方が計算しました

Please press the “Calculate” button after filling in

※(A)=(C)ー(B)

※(B)=(C)× 20.42%

※(C)=(A)+(B)

5. Summary

Foreign residents in Japan are required to pay premiums for the “National Pension system,” or “Employees’ Pension system.”

・National Pension: All residents of Japan between the ages of 20 and 59 must be enrolled, including students, self-employed persons and their spouses, and unemployed persons

・Employees’ Pension: People who work for Japanese companies must be enrolled

When you calculate the amount of the Lump-sum Withdrawal Payment for the National Pension, you need check the contribution-paid period and the final month when the insurance premium was paid. Then, you can reflect them in the table of the payment amount.

When you calculate the amount of the Lump-sum Withdrawal Payment for the Employees’ Pension, you need to use the formula, “Average standard remuneration x Payment rate.”

LIGHTBOAT offers the NENKIN Support, which conducts your claim for the Lump-sum Withdrawal Payment and provides an automatic calculator for your payment amount. Please use our service to smoothly process your Lump-sum Withdrawal Payment.